U.S. gas utilities acquisition: A transformative deal

In September, we announced the US$14-billion ($19-billion) acquisition of three U.S. natural gas utilities from Dominion Energy. This is a rare and unprecedented opportunity to acquire high quality, growing natural gas utilities at scale and at a historically attractive valuation.

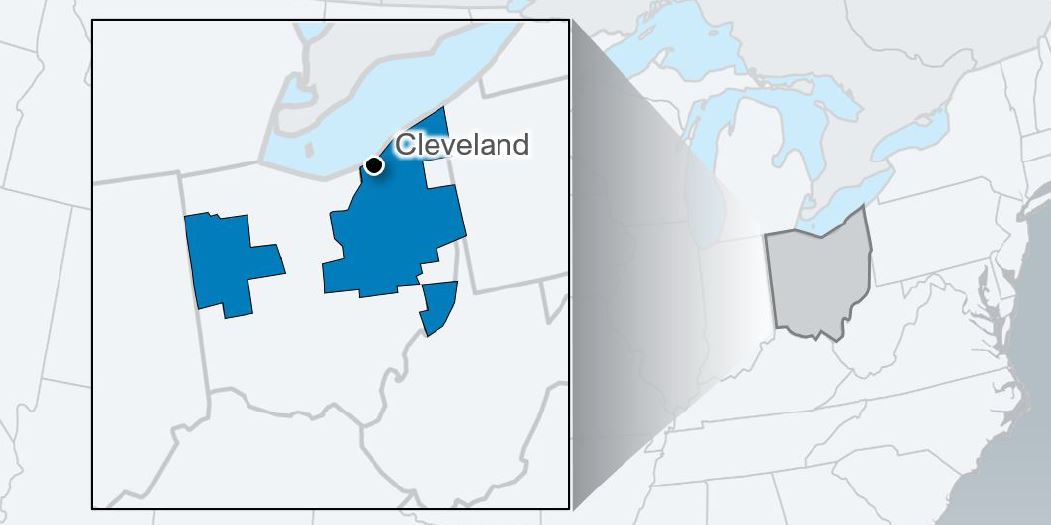

On March 7 of this year, we completed the first of these important acquisitions—of The East Ohio Gas Company (now doing business as Enbridge Gas Ohio), following the approval by the Public Utilities Commission of Ohio.

The U.S. utilities acquisition is a transformative opportunity that establishes Enbridge as the largest (by volume) natural gas distribution company in North America.

The utilities are ‘must-have’ infrastructure for providing safe, reliable and affordable energy for some three million customers in Ohio, North Carolina, Utah, Wyoming and Idaho, and add to the four million customers we currently serve through our Ontario gas utility.

And similar to Enbridge’s existing business units, the utilities have a commitment to embedded sustainability and lower carbon initiatives in their operations.

The acquisition supports a more diversified Enbridge, lowers our already industry-leading business risk profile, elevates our existing utility-like model and underpins the longevity of our growth profile—both earnings and dividends.

We have protected our balance sheet strength by employing a flexible funding plan that includes equity prefunding and asset recycling. Enbridge is positioned to fund the remainder of the transaction using the variety of options available to us.

For shareholders, once again this acquisition aligns with our low risk value proposition: stability, strength, consistency, growth and optionality.